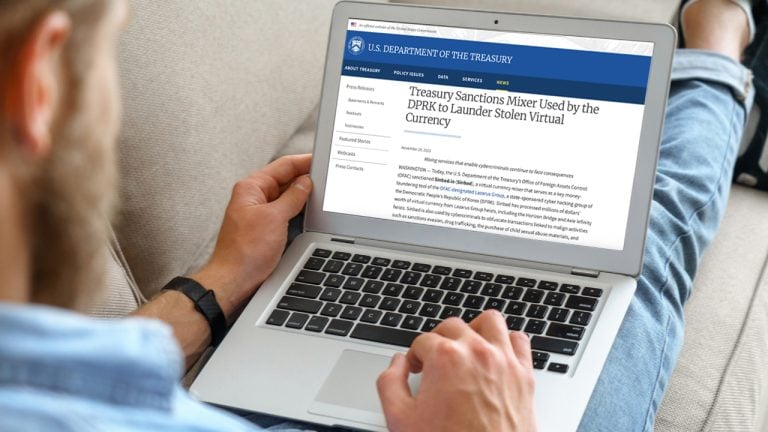

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has imposed sanctions on yet another cryptocurrency mixing platform, labeling Sinbad.io as a “key money-laundering tool” used by the North Korean Lazarus Group crime syndicate. Sinbad.io, in addition to handling transactions originating from the Democratic People’s Republic of Korea (DPRK), has also been linked to processing transactions associated with drug trafficking and sales on darknet marketplaces.

OFAC Sanctions Sinbad.io; Agency Claims Mixer Helped Obscure Funds Stolen From Harmony Bridge, Axie, and Atomic Wallet

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) and OFAC have turned their attention towards digital currency mixing protocols. While Tornado Cash and Blender.io were previously targeted by both agencies, the latest subject of scrutiny is the mixer known as Sinbad.io. This service operates as a bitcoin (BTC) mixing platform, and according to OFAC, its primary function is to obscure transaction details, effectively concealing the flow of funds on the blockchain.

OFAC’s investigation has revealed that this mixer has been utilized by the infamous North Korean hacking group, Lazarus Group. Furthermore, it has been implicated in laundering funds obtained from the Harmony Horizon Bridge and Axie Infinity hacks. OFAC has now identified it as the “preferred mixing service” for the Lazarus Group, following the takedown of Blender.io. “Sinbad was used to launder a significant portion of the $100 million worth of virtual currency stolen on June 3, 2023, from customers of Atomic Wallet,” OFAC detailed.

“Mixing services that enable criminal actors, such as the Lazarus Group, to launder stolen assets will face serious consequences,” said Wally Adeyemo, the deputy secretary of the Treasury. “The Treasury Department and its U.S. government partners stand ready to deploy all tools at their disposal to prevent virtual currency mixers, like Sinbad, from facilitating illicit activities.”

This development comes in the wake of FinCEN’s recent update in late October, where it introduced new regulations requiring financial institutions to report transactions involving international cryptocurrency mixing services. At the time, Andrea Gacki, the director of FinCEN, and Adeyemo expressed their determination to combat illicit activities linked to digital currency mixing services.

Even before the proposed rules, the Treasury’s OFAC had been actively taking enforcement actions against mixers such as Blender and Tornado Cash. Simultaneously, OFAC had identified and flagged numerous sanctioned cryptocurrency addresses across various networks. The Treasury also warns that U.S. persons who “engage in certain transactions with the entity designated today may themselves be exposed to sanctions.”

What are your thoughts on this story? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/Vc6GPkM

https://ift.tt/U9oKxFg

0 Comments